Read how Templafy helps companies with their corporate branding and brand management.

The relationship between branding and business success

In recent PWC research, it was revealed that a major factor in a business’ success is its brand image; with companies seen as having a stronger identity outperforming their competitors by 25%.

These stats are far from surprising. Think of the world’s most successful brands and immediately you can conjure up their brand visuals such as logos, imagery, and fonts – from McDonald’s golden arches to Coca-Cola’s swirling Spencerian script, Apple’s minimalist vibe to Google’s multi-colored sequence.

Whether branding financial services, legal companies or consumer brands, cultivating strong brand identity has a long list of benefits – building trust, creating financial value, securing employee buy-in and of course maintaining and growing your client base.

The relationship between branding and business success

However, as Apple’s founder, Steve Jobs, once said, “design is not just what it looks like and feels like. Design is how it works.” The best brands go beyond a great logo design to implementing brand design elements that have an impact and purpose in the real world; executing these changes with innovative, consistent and strategic implementation.

In our new branding series, we take a look at both established and disruptor companies that are shining examples of this brand-led approach and how branding plays out in different industries. First up – branding financial services…

Branding financial services: Why is branding important in financial services?

With reputational hangovers from 2007, the emergence of digital-only players, rising security concerns, and innovation in the form of blockchain, AI and robo-advisers, the importance of branding financial services has become a fundamental strategic priority for financial institutions of every type.

Creating and maintaining a strong brand image to stand out both from competitors and within the industry, is compounded by the public’s general sentiment toward the financial industries. For instance, a recent UK YouGov survey placed the reputation of the financial services industry at 26th out of 26; lower than even the gambling industry.

From fintech to traditional banking, here are some of the best financial service branding strategy case studies — trailblazing examples of companies who got branding financial services right.

Virgin Money

When Clydesdale and Yorkshire Bank Group (CYBG) took over Richard Branson’s Virgin Money in June, 2018, it created the UK’s sixth largest bank with 6 million customers and a total lending capacity of £70bn. However, while the scale of the takeover was monumental, the headline-grabbing aspect of the transaction was CYBG’s investment in the Virgin Money brand.

Instead of stamping its own name on the venture or even co-branding financial services offerings (both of which would certainly grow CYBG’s brand image and presence in the market) CYBG decided to take an alternative approach to their financial services branding strategy: All CYBG businesses were to be rebranded as Virgin Money. This meant CYBG had to license the Virgin Money brand for £12m a year, a figure set to rise to £15m by 2022.

It’s important to acknowledge that the Virgin Money brand wasn’t always as lucrative as it is now. While Virgin is one of the world’s most recognizable brands, Virgin Money itself faced huge challenges with its takeover of Northern Rock in 2011. Branson and his team had their work cut out for them, operating within an environment of huge consumer backlash and the publicized fact that it had zero credentials as a banking service — not a great look for a financial brand.

How did Branson take to branding financial services and add value to Virgin Money? He invested heavily in a brand-led bid to win over consumer favor. His £10m ad campaign pivoted around Virgin’s heritage, reminding consumers that Virgin was a brand to be trusted (a stark contrast to popular opinion towards banking) and promoted a "different", "better kind of bank" which would "put customer service ahead of cost-cutting." And this was just the launch.

For the next seven years, Virgin Money would continue to refresh and update its brand to remain competitive in its market and strengthen its position in the banking industry.

Branding financial services takeout

It pays to invest when it comes to the branding of financial services. Not only was Branson was able to secure 1% of revenues from Virgin Money brand royalties (on top of other shares and profits), but CYBG’s long-term ability to print their own money opens up exciting possibilities such as the already-discussed idea of printing Branson’s portrait on new bank notes.

Now, while not every investment has the potential to results in dollar bills with your face on it, it’s clear that in competitive or challenger markets such as the finance industry, by investing in strong branding, financial services companies can stand out and get an edge over competitors – even to the point where branding becomes more lucrative than a business’s offering. While initial branding costs may seem high, developing a great brand identity is a long, strategic game well worth playing.

Monzo

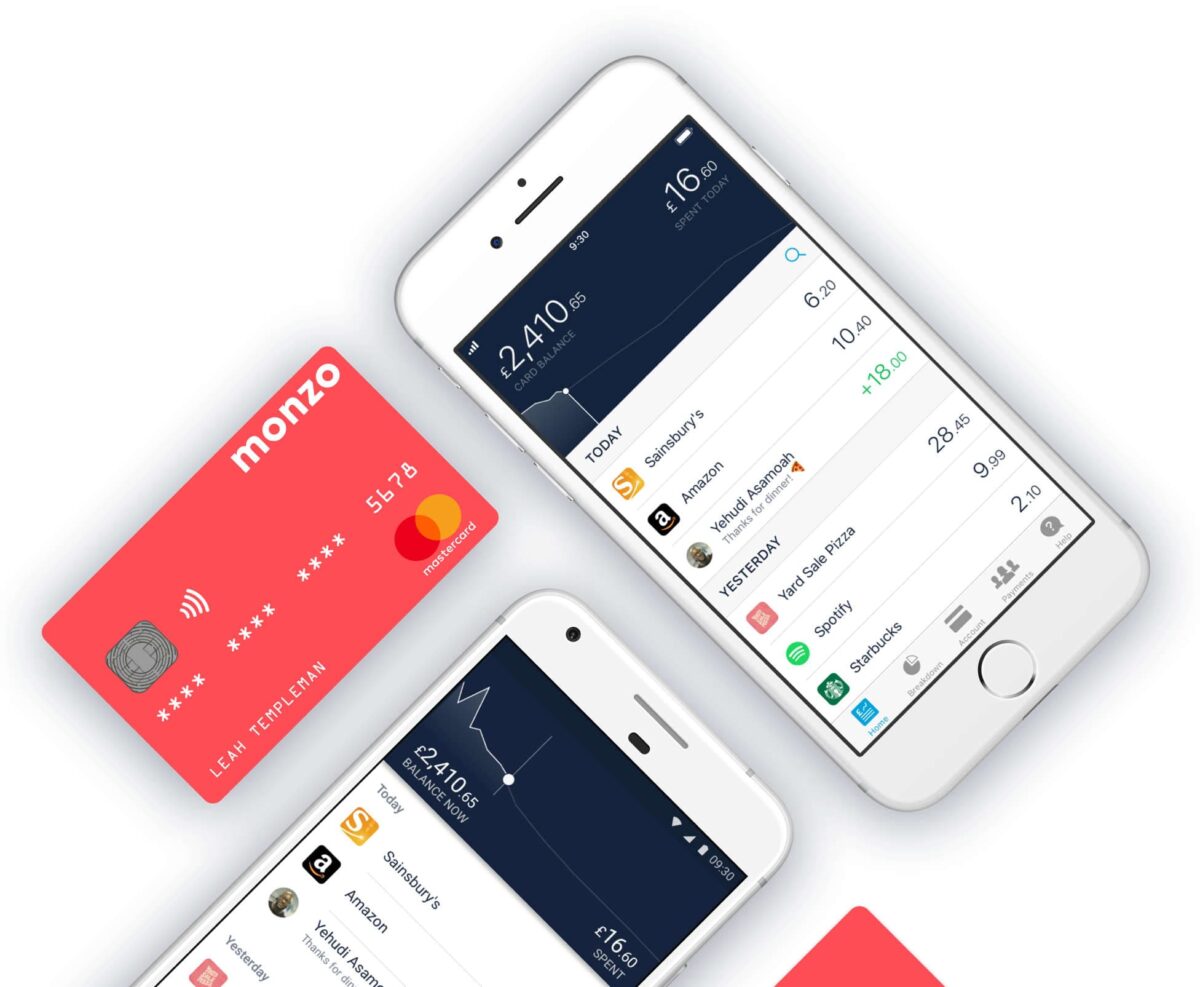

For digital products and services, "the brand" expands beyond the logo design, web design and visuals into the user experience itself. Digital design must consider usability, interaction, performance and technologies in order to deliver a service in which users find true value, and an experience that lives up to the brand.

One stand out example is the award-winning digital-only personal banking app, Monzo. With 5 million users as of 2021, Monzo has built a brand that has customer experience absolutely at its heart, differentiating it well from big banks who’s personal banking offerings often feel secondary to the more profitable investment arms.

Monzo has taken aim at the closed-on-weekends, call-center-hold-music, fill-in-6-forms-to-change-your-address world of high street banking by creating a mobile first digital bank around the needs of modern, digitally savvy and highly discerning personal banking consumers for whom convenience is king and waiting in line on the high street is unacceptable.

So for Monzo, its main financial services branding strategy is to ensure the branding reflects the product experience and vice versa. With its snappy and abstract name in keeping with digital superbrands like Uber, Spotify and Google, Monzo’s brand vision isn’t just about brand guidelines; it’s brought to life in the product itself. Every interaction and user experience reinforces the relationship between the user and the brand. Every swipe that replaces a 10 minute phone call or notification that avoids a 6 page posted statement, is a clear positioning that Monzo is the “bank of the future” built around you.

Branding financial services takeout

Positioning a financial services brand must encompass all aspects of the business’s operations. In the 21st century, this is likely to include digital products and services that either augment or even replace real-world operations. Considering the brand through digital product and service design is critical to ensuring the consumer experience lives up to the brand vision. These products and services also provide opportunity to create new value and differentiation in the eyes of the consumer through their own online experience, as has been the case for Monzo.

Read next: Hybrid work and digital transformation in financial services

NatWest

The importance of branding financial services is really felt by those competing with these new-comer challengers – aka the long standing players, fighting to maintain their brand value and market share. This is not a new phenomenon. In 1986, two of the UK’s longest standing banks; The National Provincial and Westminster bank, both formed in the 1830s, merged under a new brand; Natwest, with the aim to build and retain relevance and value amongst UK consumers.

Today NatWest continues to evolve its brand image to maintain trust, preference and relevance in the face of new competition by introducing a more diversified offering from traditional in-store services to a suite of supplementary digital products.

Unifying established physical products and new online tools under one clear and consistent brand is no easy feat. However, Natwest invested well to align its portfolio with a modern, digitally-optimized brand and visual identity redesign.

Working with design agency FutureBrand, NatWest took inspiration from its old 2D company logo design to update the brand’s entire corporate entity. “Unlocking the power of the individual cube” — the new look started with an animated 3D logo and tricolor palette and extended to a huge range of on-brand assets – playful, colorful and much more suited to a new digitally savvy audience.

These visual assets don’t just exist online on Natwest’s customer portals and website but at every single consumer touch point – bank statements, in-store signage, social media posts, TV ads, tote bags and product brochures.

Branding financial services takeout

Brand integrity is created by upholding consistency at all touchpoints. Giving your consumer a unified and authentic brand experience builds a trustworthy relationship so when it comes to adding new products or updating your business proposal, they’re ready to go on that journey with you. If your company’s communications are riddled with inconsistencies between old and new brand worlds (e.g. your app has a different logo design from your customer services email signature) this results in a conflicting brand identity and a confused consumer. The result? Suddenly you’re more exposed to competitor threats and business retention.

SDC

Alongside consistency, employee buy-in and execution of branding is absolutely essential to successfully branding financial services. Our work with Danish Fintech company SDC is a great example of this.

As SDC’s CMO Sille Stener points out: “In the FinTech market, professionalism and brand perception are vital building blocks. If our clients are going to trust us as a company, and choose our banking solutions ahead of those supplied by our competitors, image really is important.”

While Stener was spot on in her observation of the Fintech market, on joining SDC, she became aware that there were issues with brand compliance within the enterprise, with employees circulating off-brand content both internally and externally. Multiple versions of documents such as presentations with out-of-date company information and old logo designs were in use, resulting in a disjointed brand experience and in Stener’s words “unprofessionalism.”

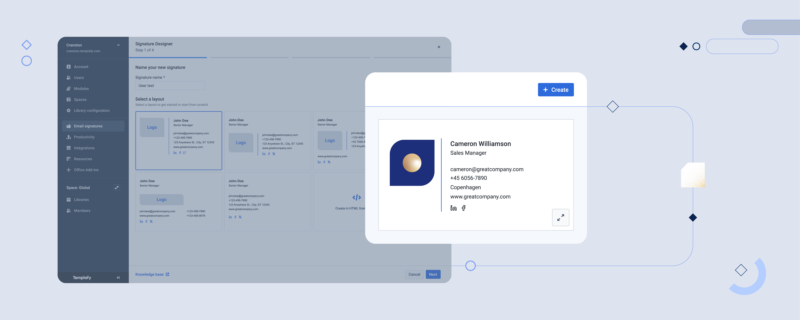

SDC and Templafy

Templafy worked with SDC to deeply integrate SDC’s Microsoft Office applications with Templafy’s digital asset library to ensure all up-to-date document templates and branding elements were easily available to employees. Hosted on Microsoft Azure, Templafy enabled SDC’s brand and content updates to be rolled out instantly across the organization without manual updates or installations. This meant that in a short space of time, SDC’s 9,500 employees became effective, daily brand ambassadors for the company - having the tools to easily create and distribute on-brand content at all times.

On the result, Stener commented: “On a brand level, we definitely come across as being more professional – there is less maverick content in our presentations. Also, because it is so easy to use, we have experienced a real win-win situation. With [this new solution] it is easier to produce on-brand content than to go off-brand. From the CEO and throughout the entire team.”

Branding financial services takeout

Make your employees your brand ambassadors. As daily communicators of your brand identity, employees are instrumental in the successful implementation of a company’s branding. Whether presenting sales pitches, drafting contracts or sending emails, it’s key that internal teams are aligned with your brand identity and have the tools they need to remain on-brand.